Streamline everything. Take actions. Get insights. Let Traders do the rest when you Start Your Own Forex Brokerage

Powerful Solutions for the Digital Age

Organize, track, and develop your brand with our Forex CRM System.

Customer

Engagement

Maximum

Automation

Team

Collaboration

Cost-

Effectiveness

Time

Optimization

Data-Driven

Decision Making

Industry

expertise

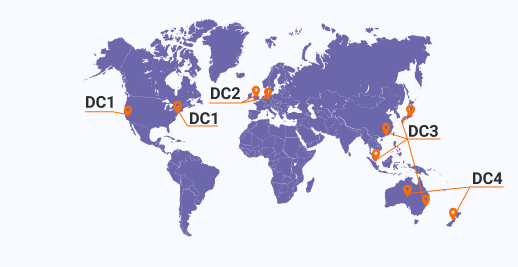

Global

Reach

Battle-Tested

Reliability

Uncompromized

Security

Multi-jurisdictional

Compliance

Team

Mobility

Start Your Own Forex Brokerage with us

0 + years

in Forex Industry

0 +

daily users

0 +

countries

Use Kenmore Design Powered Services

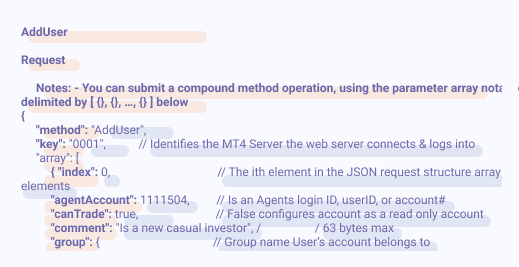

Developer-Friendly

All Kenmore Design Forex Web Solutions are API-Based which means they are built with expansion in mind. We offer full support and close collaboration with developers which will exceed your expectations.

- Well Documented API

- Simple JSON API

- Data Security and Encryption

- High Availability

- Staging Environment

- Dedicated Support